VIZIO Announces Pricing of Initial Public Offering

IRVINE, Calif.--(BUSINESS WIRE)--VIZIO Holding Corp. ("VIZIO") today announced the pricing of its initial public offering of 12,250,000 shares of its Class A common stock at a price to the public of $21.00 per share. VIZIO is offering 7,560,000 shares of its Class A common stock, and certain selling stockholders are offering 4,690,000 shares of VIZIO’s Class A common stock. In addition, the underwriters of the initial public offering have been granted a 30-day option to purchase up to an additional 1,837,500 shares of Class A common stock from the selling stockholders at the initial public offering price, less underwriting discounts and commissions. VIZIO will not receive any proceeds from any sales of shares by the selling stockholders. The shares are expected to begin trading on the New York Stock Exchange on March 25, 2021 under the symbol "VZIO" and the offering is expected to close on March 29, 2021, subject to customary closing conditions.

J.P. Morgan and BofA Securities are acting as lead book-running managers for the offering. Wells Fargo Securities and Guggenheim Securities are also acting as book-running managers for the offering. Needham & Company and Piper Sandler are acting as joint lead managers, and Roth Capital Partners is acting as co-manager for the offering.

A registration statement relating to these securities was declared effective by the U.S. Securities and Exchange Commission on March 24, 2021. The offering is being made only by means of a prospectus. Copies of the prospectus related to the offering may be obtained from: J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 or by telephone at 866-803-9204 or by email at prospectus-eq_fi@jpmorganchase.com; BofA Securities, Attention: Prospectus Department, NC1-004-03-43, 200 North College Street, 3rd Floor, Charlotte, NC 28255-0001, or by email at dg.prospectus_requests@bofa.com.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

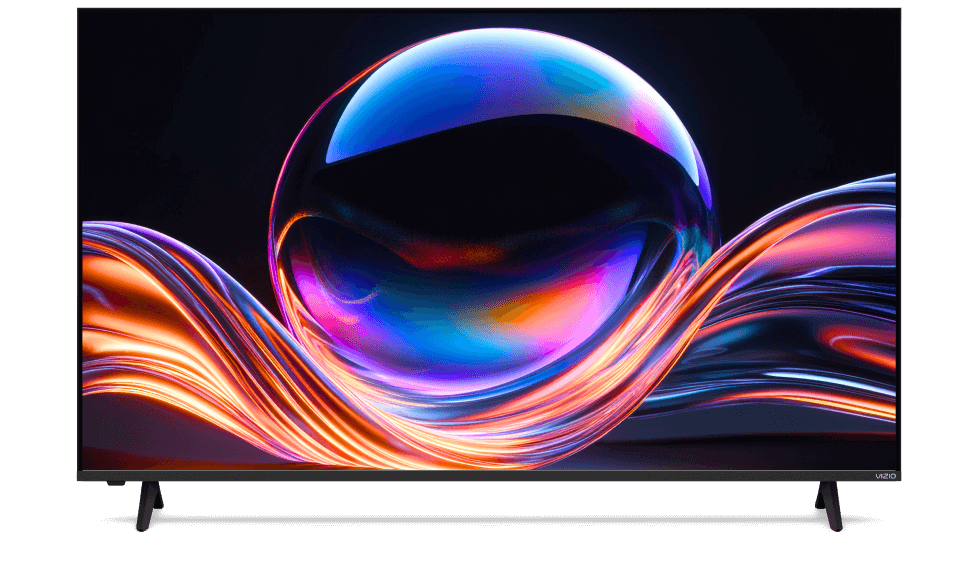

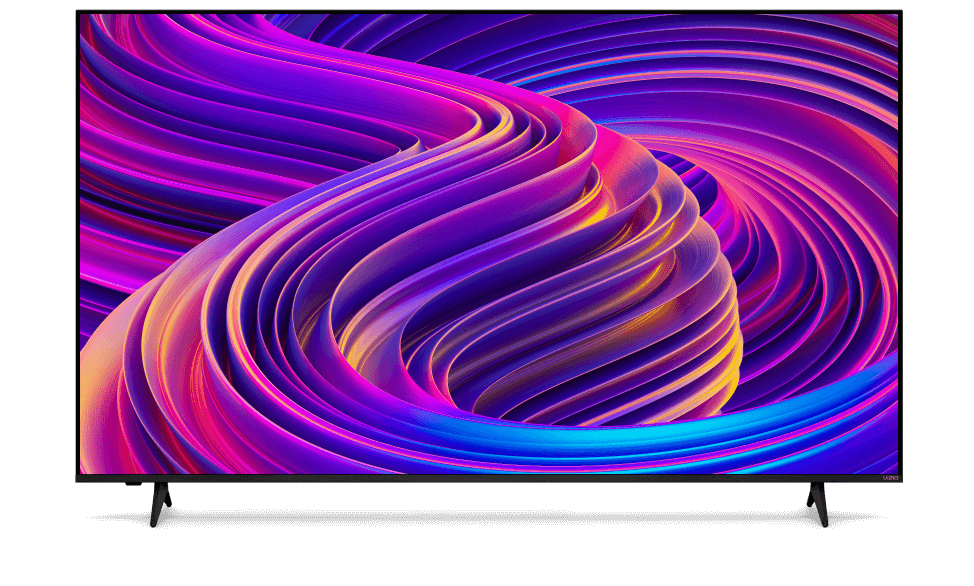

About VIZIO

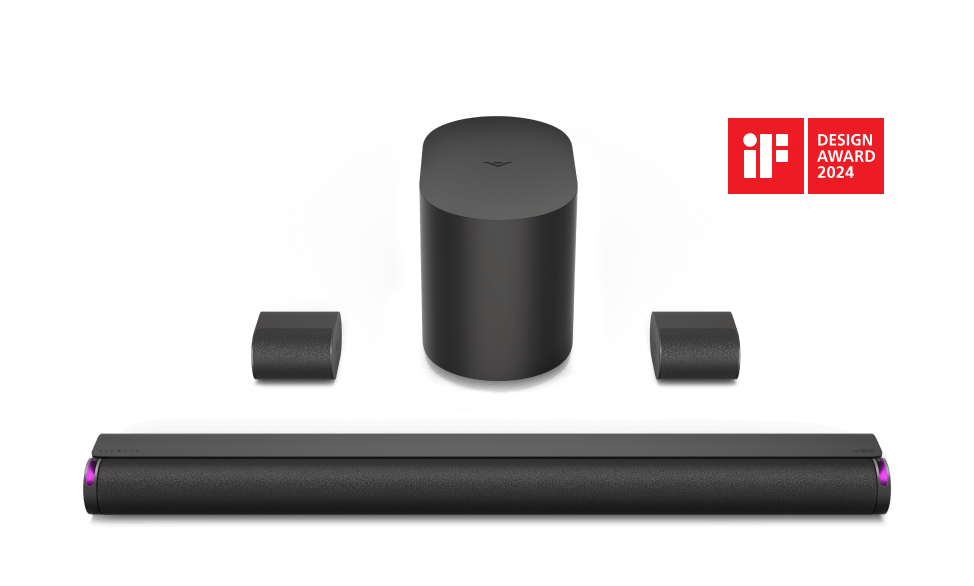

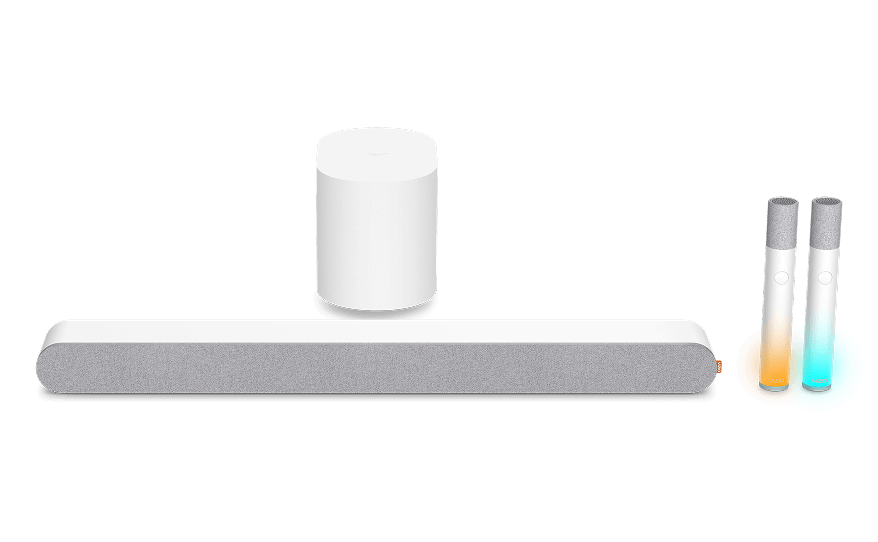

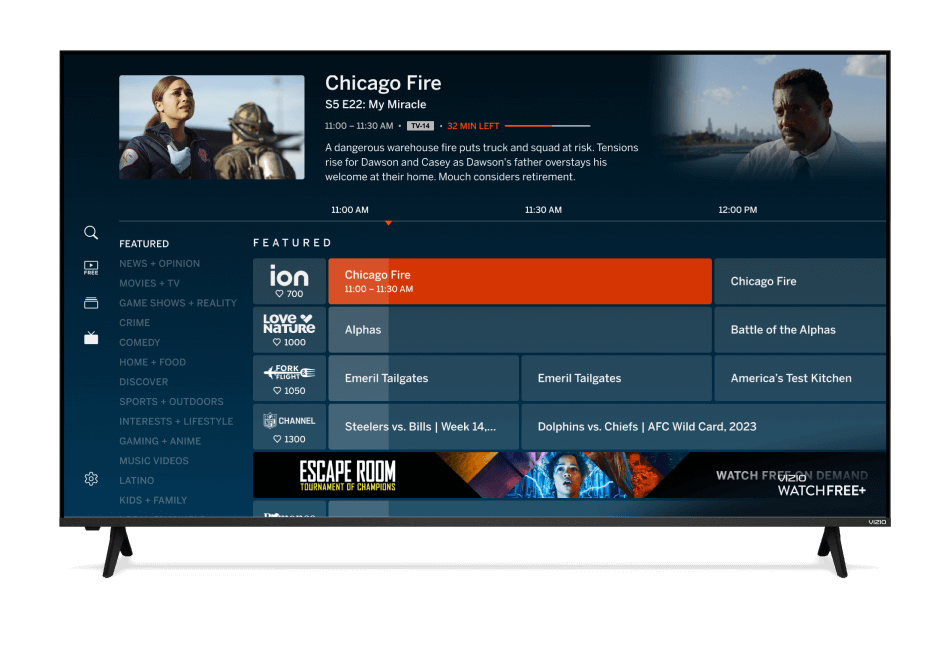

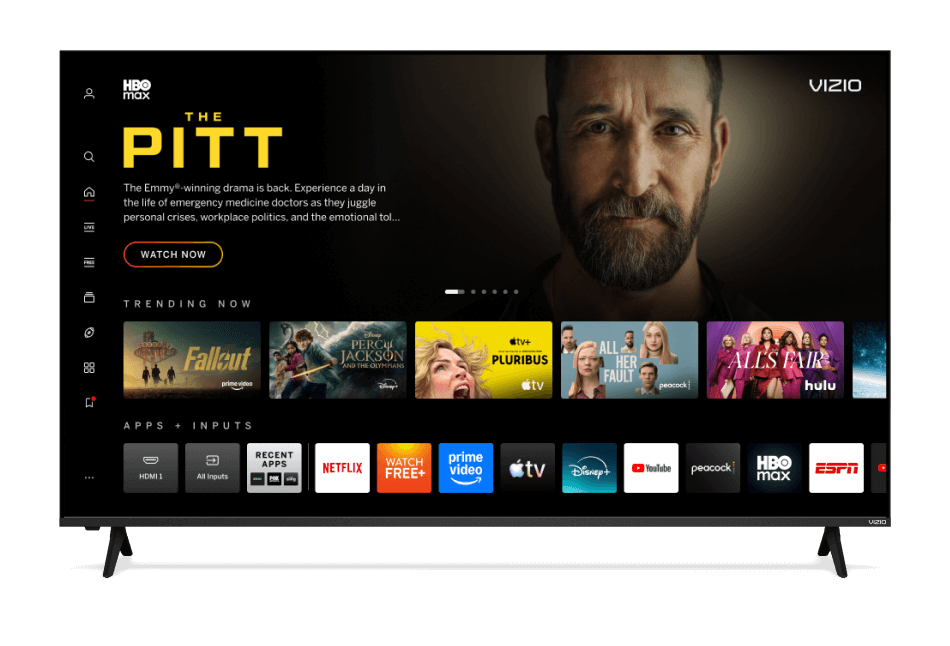

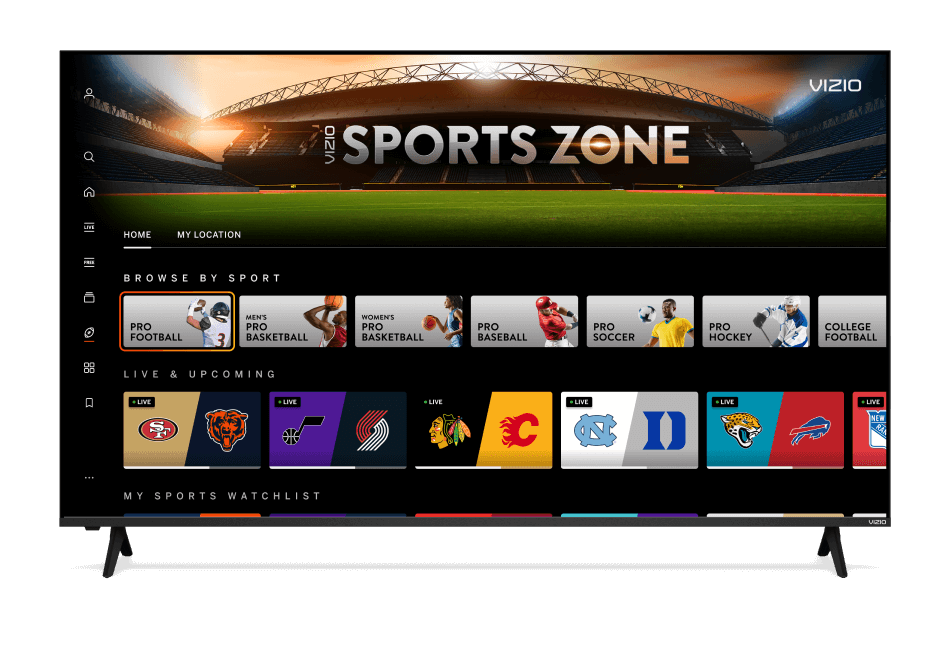

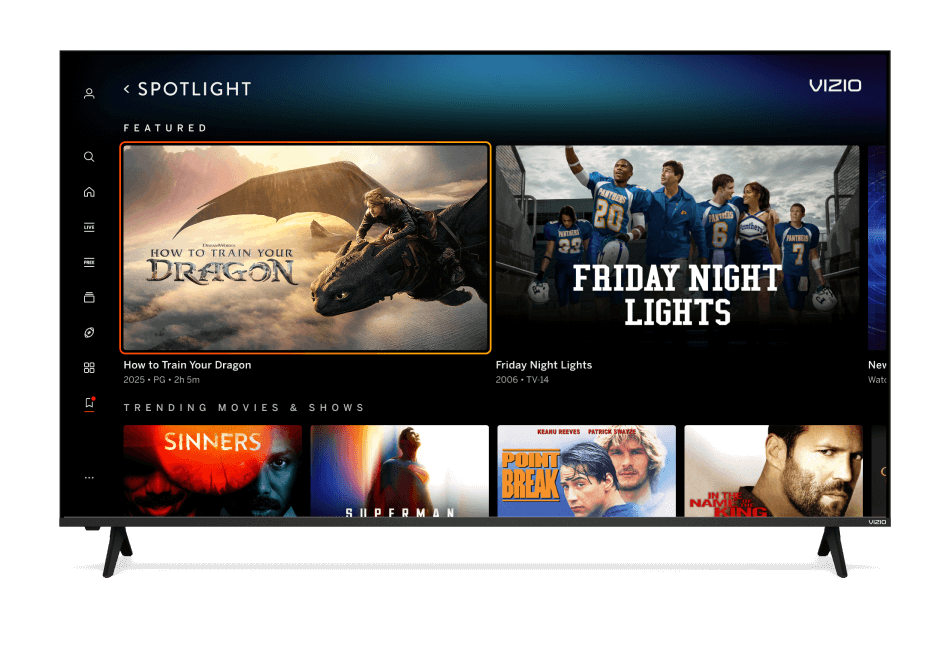

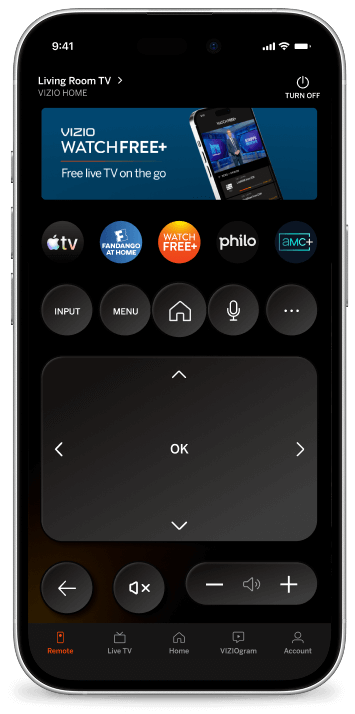

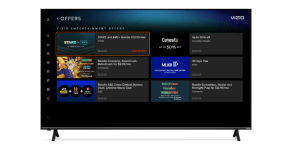

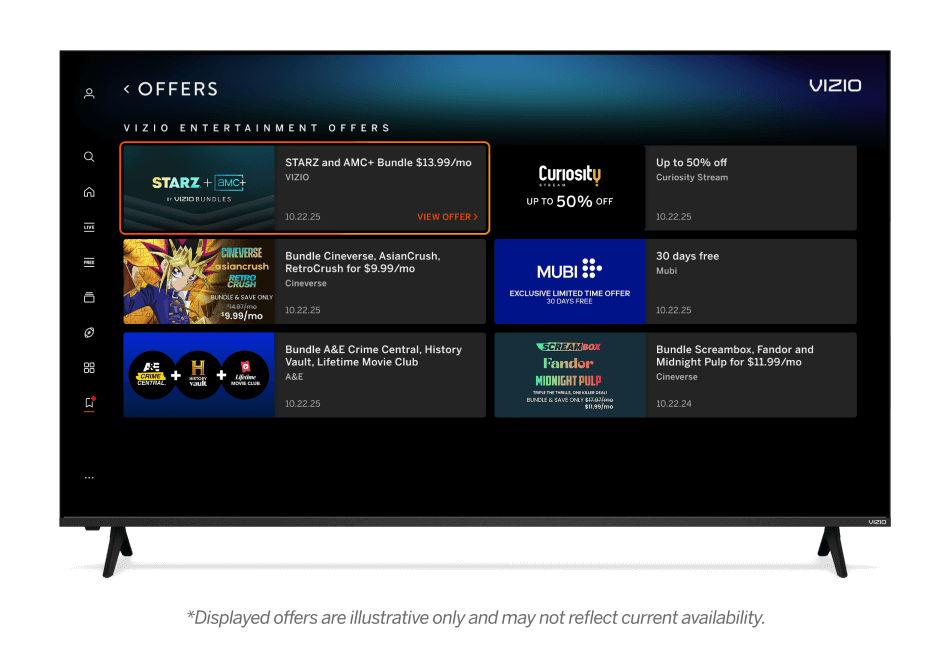

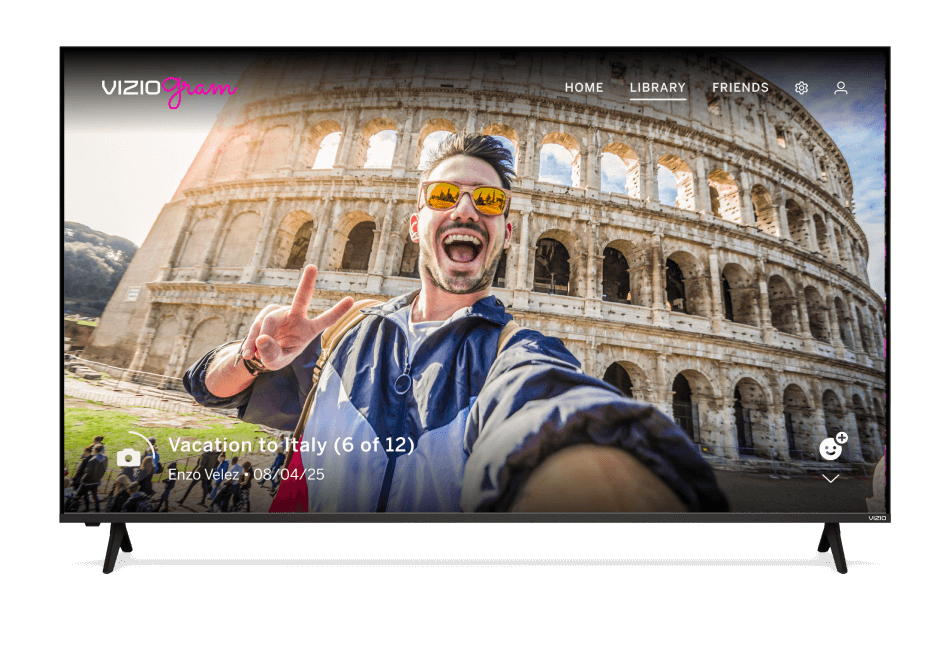

Founded and headquartered in Orange County, California, VIZIO's mission is to deliver immersive entertainment and compelling lifestyle enhancements that make our products the center of the connected home. VIZIO is driving the future of televisions through its integrated platform of cutting-edge Smart TVs and powerful SmartCast operating system. VIZIO also offers a portfolio of innovative sound bars that deliver consumers an elevated audio experience. VIZIO's platform gives content providers more ways to distribute their content and advertisers more tools to target and dynamically serve ads to a growing audience that is increasingly transitioning away from linear TV.

Contacts

Press Contact

Jodie McAfee

press@vizio.com

Investor Relations Contact

IR@vizio.com