NATM Dealers Coping With Strained Margins

September 16, 2009

By: Alan Wolf

TWICE

Dallas - NATM dealers are learning to live in a low-margin marketplace.

The 11-member buying group, comprised of some of the industry's largest independent and multi-regional dealers, is riding out the recession through cost cuts, opportunistic buys, and boosts from ancillary businesses like home office and audio.

"We're still here, still competing, and learning to play in this environment," said Bill Trawick, president and executive director of the $3 billion group, which is holding its annual conference here this week at the Gaylord Texan in Grapevine.

Recession-weary shoppers are looking for deals, he said, and the CE and major appliance industries have responded in kind, putting pressure on profits.

But compounding the problem is "a very aggressive" price war between national chains, which is further eroding margins and putting the entire marketplace at risk.

"Everyone gets caught in that," Trawick said. "I hope the vendors won't let the whole industry collapse."

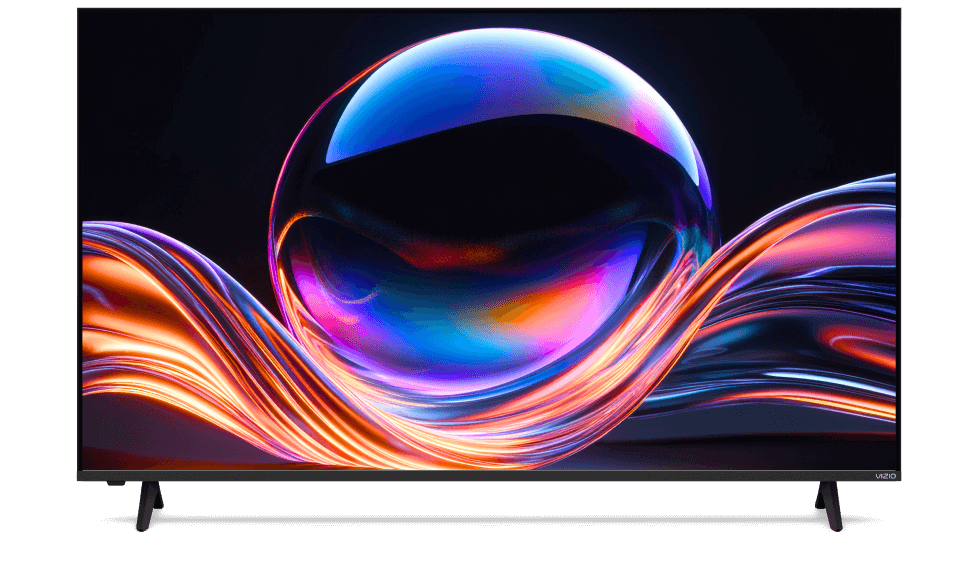

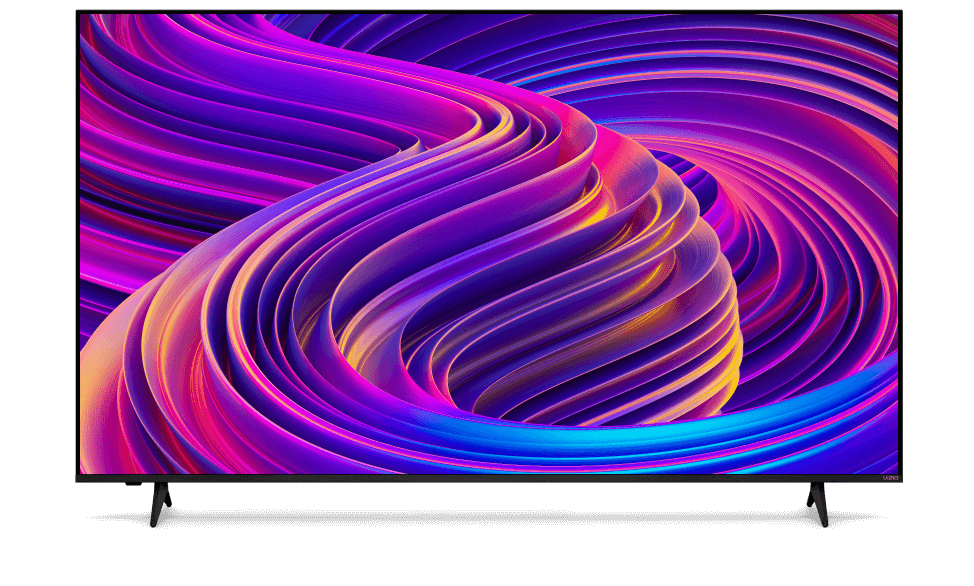

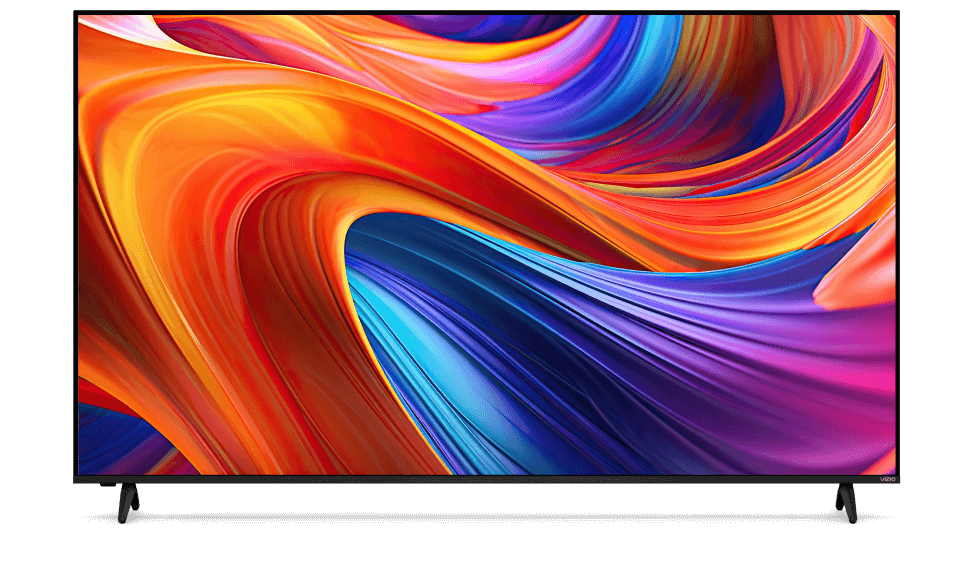

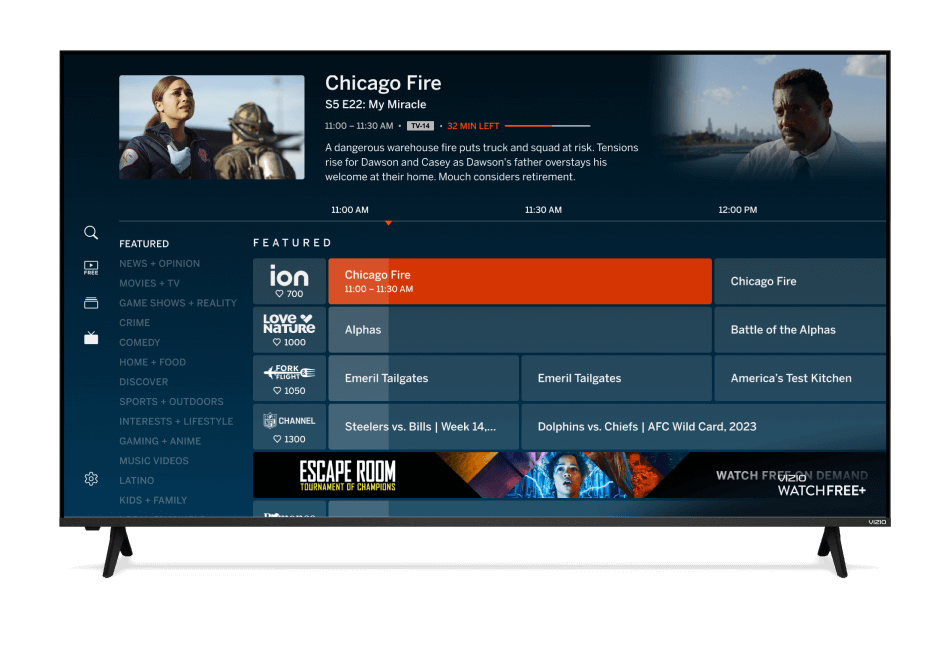

Dealers told TWICE the situation stems from underperformance in TV by Best Buy's private-label Insignia and Dynex brands, which it has employed to counter value badges like Vizio. Instead, the No. 1 CE chain is now turning to tier-one vendors for opening-price-point products, further disrupting the market.

To contend with the margin squeeze, NATM dealers are buying into oversupply situations and are exploiting non-traditional categories like home office and component audio, where product lines and market share have been freed up by Circuit City's departure.

Members are also cutting overhead, often through headcount reductions, but are also taking advantage of the weak commercial real estate market to expand their businesses. Among those opening new stores is Conn's, which plans to add three to five locations this year; BrandsMart USA, which opened its fourth Atlanta superstore last month; and ABC Warehouse and Electronic Express, which have snapped up several former Circuit City sites.

Sam Yazdian, president of Electronic Express, said the Tennessee chain reopened a former Circuit City store in Spring Hill three months ago, will relocate its 12,000-square-foot Clarksville store to a 21,000-square-foot Circuit site in November, and will also reopen a former CompUSA storefront in Brentwood next month, raising its store count to 18.

All told, NATM's sales volume has declined to just more than $3 billion, a mid-teen percentage drop driven by weaker white-goods demand, falling TV prices, and the departure last spring of Grant's Appliances in Joliet, Ill.

Broken out by category, white-goods sales are down by the high-single digits, but still outperforming an industry that is experiencing 15 percent declines.

In TV, unit sales are ahead in the upper 20 percent range, Trawick said, although dollar volume is "getting hurt" as average selling prices crater. The contraction has been offset somewhat by sales of LED TVs, which are carried by some of NATM's members.