Could this finally be the season for Web TV?

USA Today

By: David Lieberman

November 13, 2009

NEW YORK — You have good reason to be skeptical when someone says millions of ordinary television viewers are about to start surfing the Internet on the living room's electronic hearth.

We've heard that Web-on-your-TV convergence promise for more than a decade, with ambitious efforts to make it happen including AOL TV and WebTV Networks. Each time, the optimists have been wrong.

This year might be different.

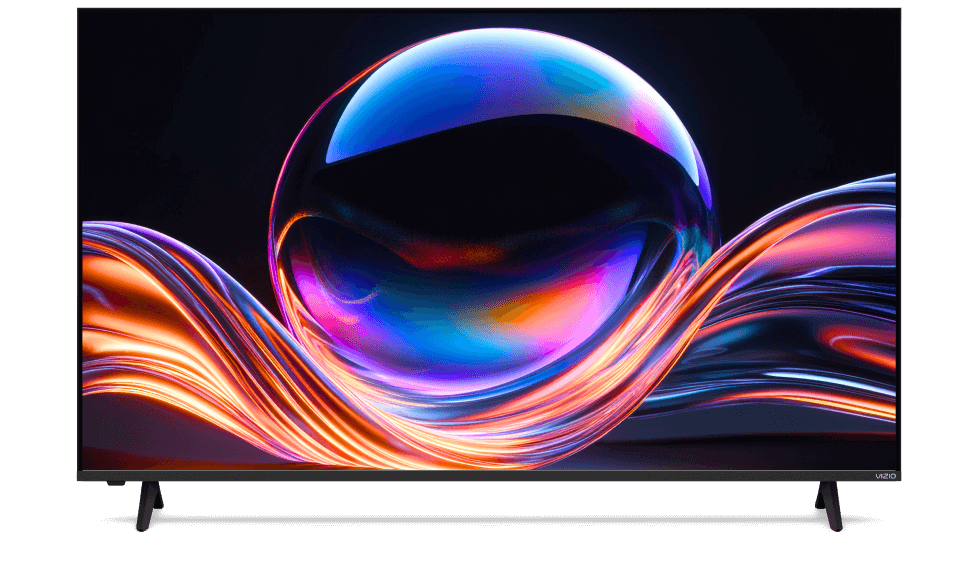

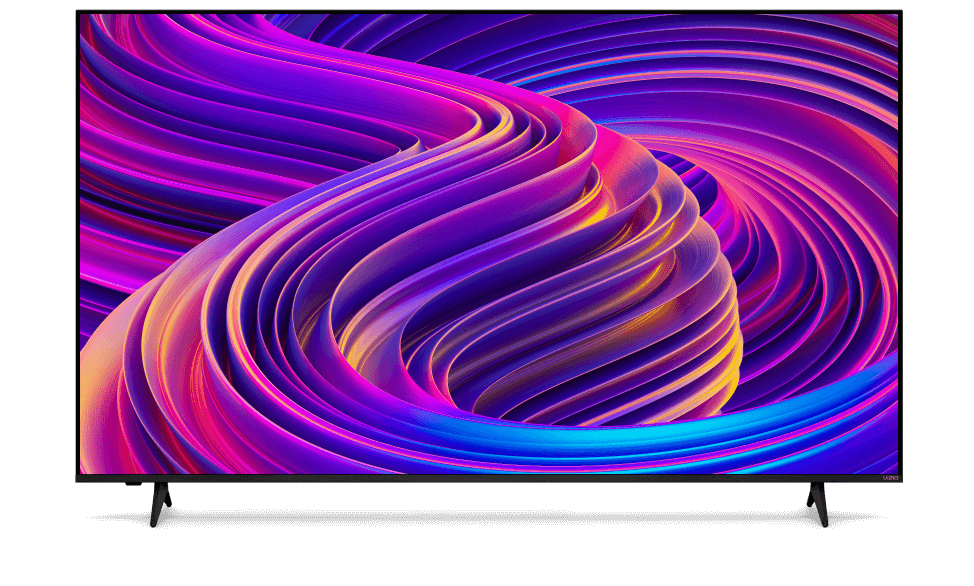

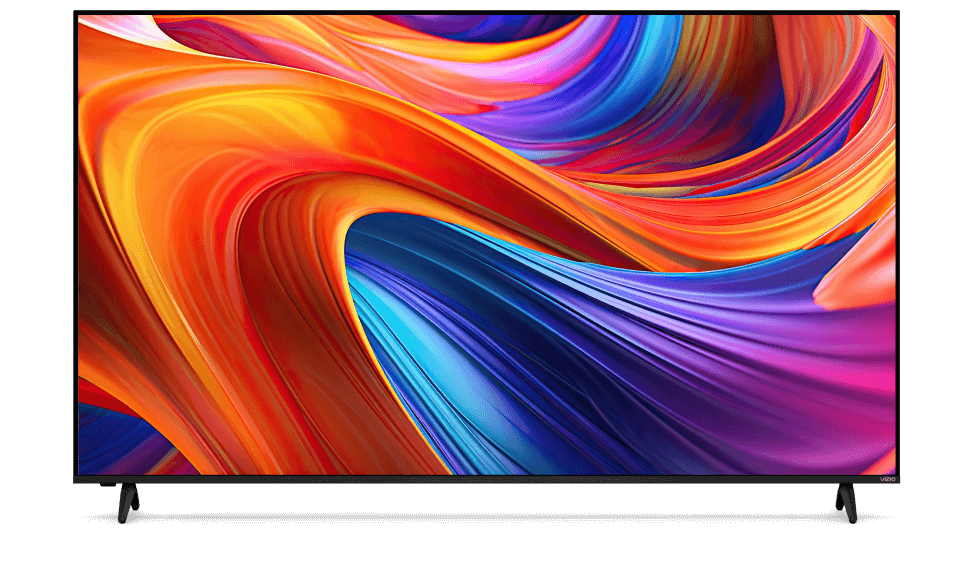

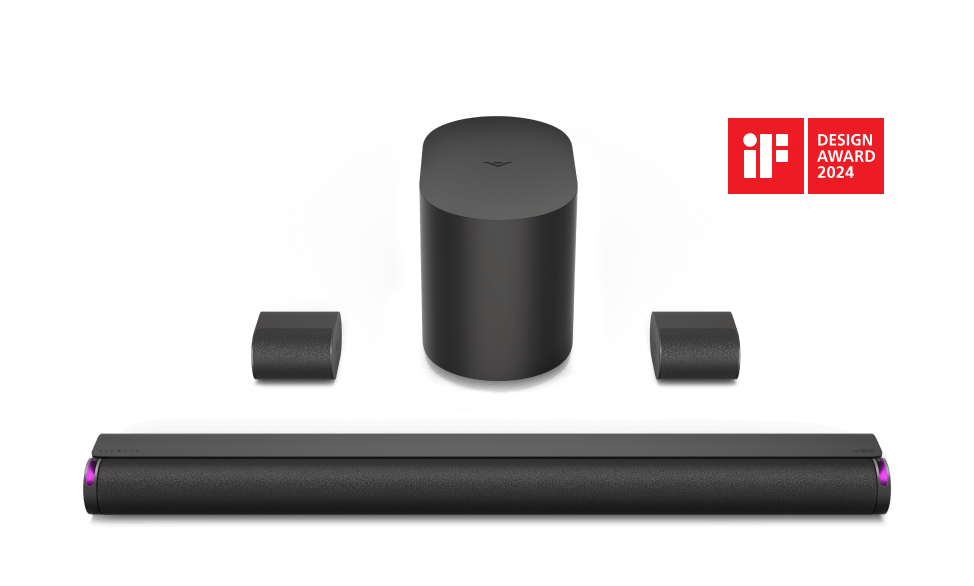

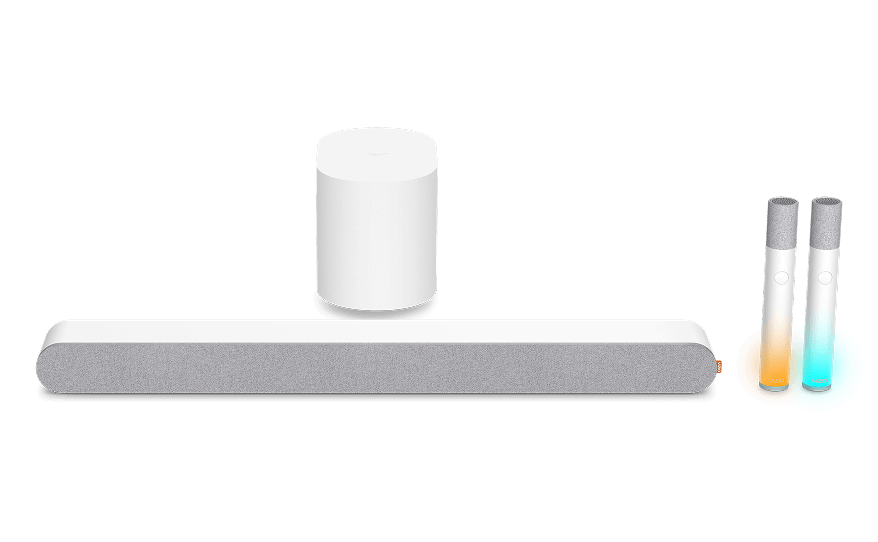

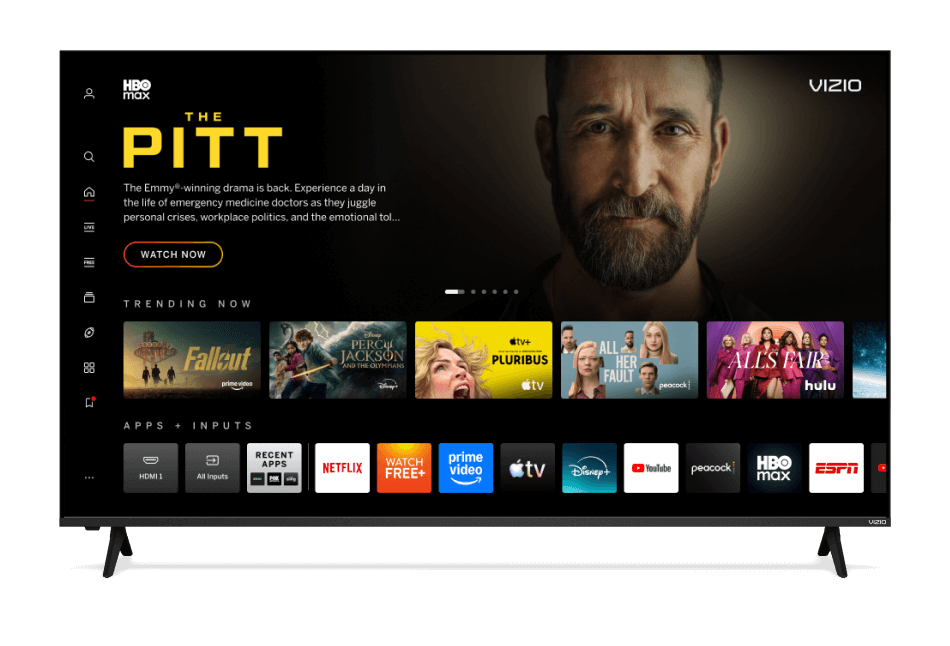

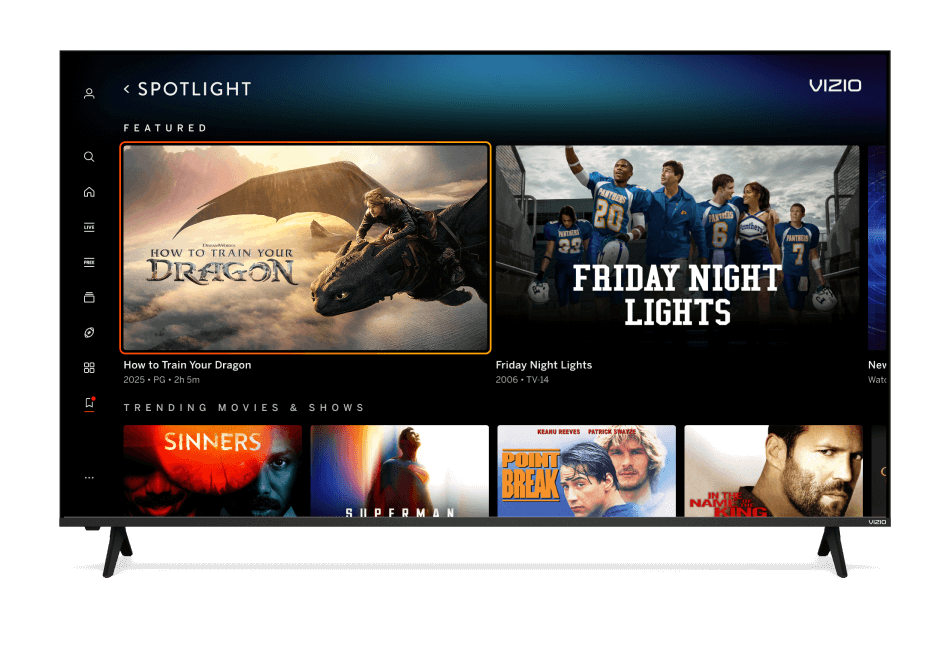

Big TV manufacturers including Sony, LG, Panasonic and Vizio say that they're poised to revolutionize television this Christmas shopping season: They're about to launch the first major marketing push for a new generation of sets that can easily integrate Web content with traditional TV news and entertainment — without the fuss of connecting the TV to a set-top box.

"When we all open up the newspapers on Jan. 1, and they talk about the hot items from the holiday selling season, Internet-connected TVs are going to be at the top of the list," says Randy Waynick, senior vice president at Sony's Consumer Group.

The campaign could be risky. Consumers may balk if TV sets become too computerlike and complicated. Manufacturers are in a race with cable companies and gadget providers — including makers of DVRs, Blu-ray players and game machines — who offer alternative ways to blend the Internet with TV.

But the new versions of Web TVs will soon become the norm in consumer electronics stores. In 2014, consumers in North America will buy 45 million of these sets, representing 69% of all TV sales, ABI Research says. That's up from 6 million and 14% of sales in 2009.

As they catch on, television will become "a completely new ballgame," says Matthew McRae, general manager of advanced technology products at Vizio. Software developers will flock to the new platform, making Web TVs "the next area of innovation" following computers and cellphones, he says.

Lesson learned

Manufacturers say they learned an important lesson from earlier convergence failures: Viewers want to relate to sets as televisions, not computers.

That's why the new Web TV models don't come with browsers that would give people the freedom to surf the full Internet, even though the TVs connect to the Web via an ethernet cable or home wireless network. The companies want to promote consumer acceptance of Web TV by making the technology simple to use: That means no keyboard or mouse.

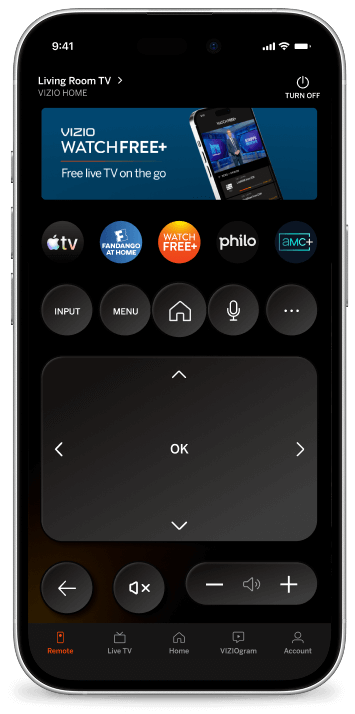

It's just Step 1: Engineers are talking about changes that would make it easy to navigate the Internet. One thought is to program smartphones so they can change channels, send text messages to the set and move a cursor around the screen with the motion-sensitive technology that Nintendo uses with its Wii game system.

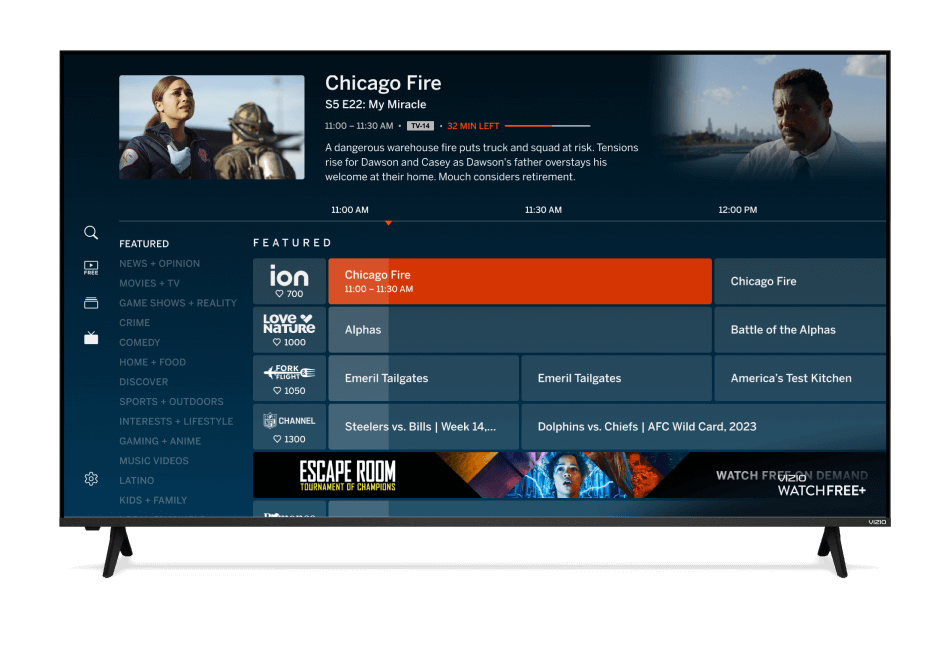

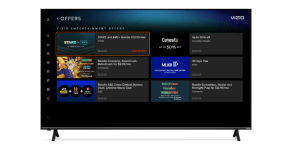

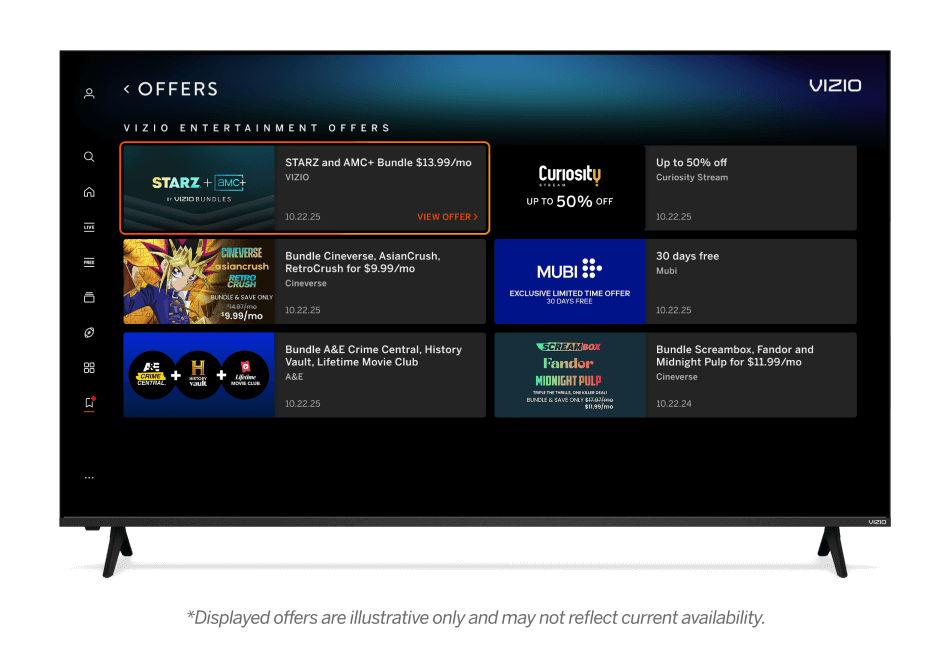

For now, though, people just need the TV remote control to select and launch prepackaged applications. Yahoo, the clearinghouse for most of these apps, calls them widgets.

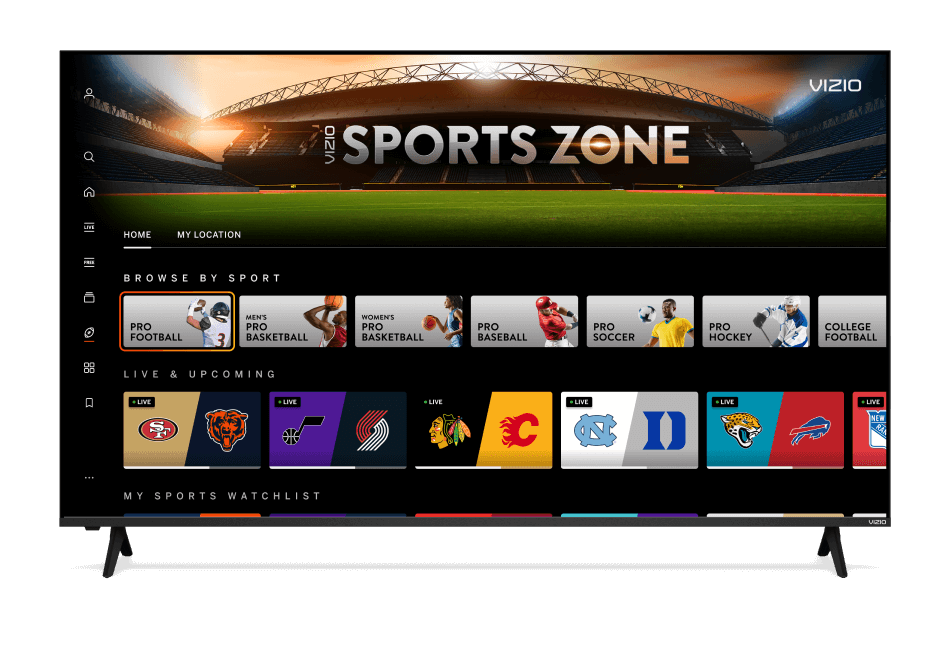

The handful now available make it possible to call up news headlines, weather, stock prices, sports scores and more while watching conventional TV channels. Some widgets can summon information about new bids from an auction on eBay and the latest posts from social-networking services such as Facebook and Twitter.

Web TV sets also typically make it possible to watch videos from Internet-based providers including YouTube, Break.com, Blip.tv and SingingFool. (CBS makes some of its traditional TV shows including CSI and As the World Turns available via the Internet to some Web-connected sets. But ABC, Fox and NBC — which provide shows online at their own sites and Hulu — do not.)

The widget offerings can vary by manufacturer. Vizio, for example, has an exclusive arrangement to provide music from Rhapsody. Sony will rent its animated movie Cloudy with a Chance of Meatballs in December, before it's out on DVD, to people who own one of its Internet-connected TVs or Blu-ray disc players.

But the range and sophistication of services are expected to grow quickly.

Manufacturers are gearing up to introduce Web-based phone and videoconferencing services such as Skype. They're also cutting deals with video-on-demand providers including Amazon, Blockbuster and Netflix to give movie fans the freedom to sidestep or supplement cable's VOD offerings.

These current and coming features enticed Andy Fowler, a retired finance officer for the Golden Corral restaurant chain, to buy an Internet-connected TV from LG.

"My kids are scattered all across the United States, and now I can see the news and weather where they are," says Fowler, 63, who lives in Silver Lake, Wash. Although he could also do that on a computer, "It's nice to have it on a big screen. It's easy to use. ... And more people are going to be programming for this, so it'll be nice to have."

Some Web TVs cost more than comparable sets that can't connect to the Internet. For example, Sony charges $1,100 for a model with a 40-inch screen, about $250 more than a similar set without Web connectivity.

That's not a consistent pattern, though. Samsung charges $2,200 for an LED-backlit model with a 40-inch screen, or $200 more than its counterpart without Web TV. But there's no price difference for an Internet-connected 40-inch set with an LCD screen, which costs $1,500.

Vizio says it will not charge extra for Web TV and offers a 42-inch model for $1,000.

The drive to dazzle consumers by continually offering more, and more technically demanding, services will force smart shoppers to look beyond picture and sound quality when they buy a set. They'll have to consider the strength of the processor, the amount of memory and the kinds of software installed.

People also may feel pressure to replace sets every few years to take advantage of new applications that require more powerful hardware.

"That's why there's some debate as to how successful this ultimately is going to be," says Nick Wilson, chief technology officer for Web video firm Break Media. "There's only so much you can do by upgrading software inside the device before you have to go through a hardware revision."

If consumers become frustrated, it could open the way for cable operators.

Cable executives say that just about anyone who has a digital cable service will soon be able to call up the same interactive services that TV manufacturers are promising.

Consumers also would not have to worry about connecting the TV to the Internet because "it all comes through the cable system," says Paul Liao, CEO of CableLabs, the cable industry's research-and-development arm.

Cable operators have a strong incentive to move quickly to offer Internet services on television sets. If they don't, subscribers may discover they can satisfy their news and entertainment needs from the Internet on their Web-enabled TVs — and save the $60 or so they pay each month to receive cable channels such as TBS, USA Network, ESPN, MTV.

Still, most cable operators can't offer Web services overnight.

"There are many different kinds of (cable) digital set-top boxes out there," says Liao. "They all need to have software put in (to accommodate Internet connections). And the software has to be customized to that hardware."

If cable operators move too slowly, consumers may connect their TVs to the Internet through devices from Apple TV, Roku, TiVo's Xbox game player.

Who will win the race?

"That's the $1 million question," says ABI Research analyst Michael Inouye. "It could go either way."

Yahoo widgets

TV set manufacturers say that their recent adoption of Yahoo's widgets should help make consumers and software developers more comfortable with Web-enabled televisions.

Although Sony began to offer Web-enabled TVs in 2007, "We launched (the Yahoo widgets) about six months ago," Waynick says. "So they're really just starting to come into the marketplace."

Manufacturers hope that software firms will be motivated to develop lots of Web TV apps as they see how easy it is to adapt them to different sets, says Russ Schafer, Yahoo's senior director of marketing for connected TVs and desktops.

Yahoo's rules dictate how widgets look and work, and limit spam and content that many users might deem offensive, including gambling and sexually risqué references. Manufacturers still can tailor Yahoo's widgets to suit their styles. For example, Samsung's are blue, while LG's are red. Vizio is using the widgets for all of its controls, including screen brightness and settings. (Panasonic uses a different navigation system.) But there's a bottleneck at Yahoo as it struggles to approve each application.

"I have a database of over 1,000 (firms) just waiting for a development kit so they can come onto the platform," Schafer says. "We've been holding everything back, waiting to get a fast quality-assurance process. We're trying to speed that up."

Widgets aren't a big money maker for Yahoo just yet.

"The way we will make money in the future is by advertising once we aggregate enough of an audience," Schafer says.

Yahoo's central position, though, already gives it a lot of leverage as it cuts deals with developers.

"When we start talking about ad placement, that's when they get excited because they have an ad engine," says Jeff Allen, CEO of Rallypoint, which offers data and services for fantasy sports fans. There's also a question of whose widgets stand out on the screen where viewers pick ones to download. Yahoo "has a Google or an Apple model," Allen says. "If you want to be at the top of the list, then pay a fee."

That gate-keeping strategy may work for now. But today's business plans could quickly become obsolete if optimists finally are right about convergence, and consumers clamor for the flexibility to explore the far corners of cyberspace.

"There is a whole bunch of information or communication that I rely on from the Internet," says Jeremy Allaire, CEO of Web video company Brightcove. "And I want those to be available from a remote while sitting in front of a big screen."